Rumus Dividend Payout Ratio

Dividend Yield Formula Overview Guide And Examples

Dividend Yield Formula Overview Guide And Examples

Dividend Payout Ratio | Analysis | Formula | Example Calculation

The dividend payout ratio measures the percentage of net income that is distributed to shareholders in the form of dividends during the year. In other words, this ratio shows the portion of profits the company decides to keep to fund operations and the portion of profits that is given to its shareholders.

Investors are particularly interested in the dividend payout ratio because they want to know if companies are paying out a reasonable portion of net income to investors. For instance, most start up companies and tech companies rarely give dividends at all. In fact, Apple, a company formed in the 1970s, just gave its first dividend to shareholders in 2012.

Conversely, some companies want to spur investors’ interest so much that they are willing to pay out unreasonably high dividend percentages. Inventors can see that these dividend rates can’t be sustained very long because the company will eventually need money for its operations.

Formula

The dividend payout formula is calculated by dividing total dividend by the net income of the company.

This calculation will give you the overall dividend ratio. Both the total dividends and the net income of the company will be reported on the financial statements.

You can also calculate the dividend payout ratio on a share basis by dividing the dividends per share by the earnings per share.

Obviously, this calculation requires a little more work because you must figure out the earnings per share as well as divide the dividends by each outstanding share. Both of these formulas will arrive at the same answer however.

Analysis

Since investors want to see a steady stream of sustainable dividends from a company, the dividend payout ratio analysis is important. A consistent trend in this ratio is usually more important than a high or low ratio.

Since it is for companies to declare dividends and increase their ratio for one year, a single high ratio does not mean that much. Investors are mainly concerned with sustainable trends. For instance, investors can assume that a company that has a payout ratio of 20 percent for the last ten years will continue giving 20 percent of its profit to the shareholders.

Conversely, a company that has a downward trend of payouts is alarming to investors. For example, if a company’s ratio has fallen a percentage each year for the last five years might indicate that the company can no longer afford to pay such high dividends. This could be an indication of poor operating performance.

Generally, more mature and stable companies tend to have a higher ratio than newer start up companies.

Example

Joe’s Kitchen is a restaurant change that has several shareholders. Joe reported $10,000 of net income on his income statement for the year. Joe’s issued $3,000 of dividends to its shareholders during the year. Here is Joe’s dividend payout ratio calculation.

As you can see, Joe is paying out 30 percent of his net income to his shareholders. Depending on Joe’s debt levels and operating expenses, this could be a sustainable rate since the earnings appear to support a 30 percent ratio.

Contents

Gallery Rumus Dividend Payout Ratio

Summary Of The Dependent And Independent Variables

Summary Of The Dependent And Independent Variables

Definisi Dividend Payout Ratio Atau Rasio Pembayaran Dividen

Definisi Dividend Payout Ratio Atau Rasio Pembayaran Dividen

Akuntansiotakkanan Instagram Photo And Video On Instagram

Akuntansiotakkanan Instagram Photo And Video On Instagram

Sustainable Growth Rate Definition Example How To Calculate

Sustainable Growth Rate Definition Example How To Calculate

3 Cara Untuk Menghitung Rasio Pembayaran Dividen Wikihow

3 Cara Untuk Menghitung Rasio Pembayaran Dividen Wikihow

Hubungan Kebijakan Dividen Dividend Payout Ratio

Hubungan Kebijakan Dividen Dividend Payout Ratio

Rudiyantopanduan Mencari Data Dan Menghitung Valuasi Saham

Rudiyantopanduan Mencari Data Dan Menghitung Valuasi Saham

Dividend Per Share Overview Guide To Calculate Dividends

Dividend Per Share Overview Guide To Calculate Dividends

Cash Value Added Ratio Anelda The Data Group

Cash Value Added Ratio Anelda The Data Group

Additional Funds Needed Afn Formula Pro Forma Financial

Additional Funds Needed Afn Formula Pro Forma Financial

Dividen Instagram Posts Photos And Videos Picuki Com

Dividen Instagram Posts Photos And Videos Picuki Com

Return On Common Stockholders Equity Ratio Explanation

Return On Common Stockholders Equity Ratio Explanation

Dividend Growth Rate Meaning Formula How To Calculate

Dividend Growth Rate Meaning Formula How To Calculate

Download Fibonacci Retracement Calculator In Excel Using

Download Fibonacci Retracement Calculator In Excel Using

Estimating External Funds Requirement Efr Of A Firm

Estimating External Funds Requirement Efr Of A Firm

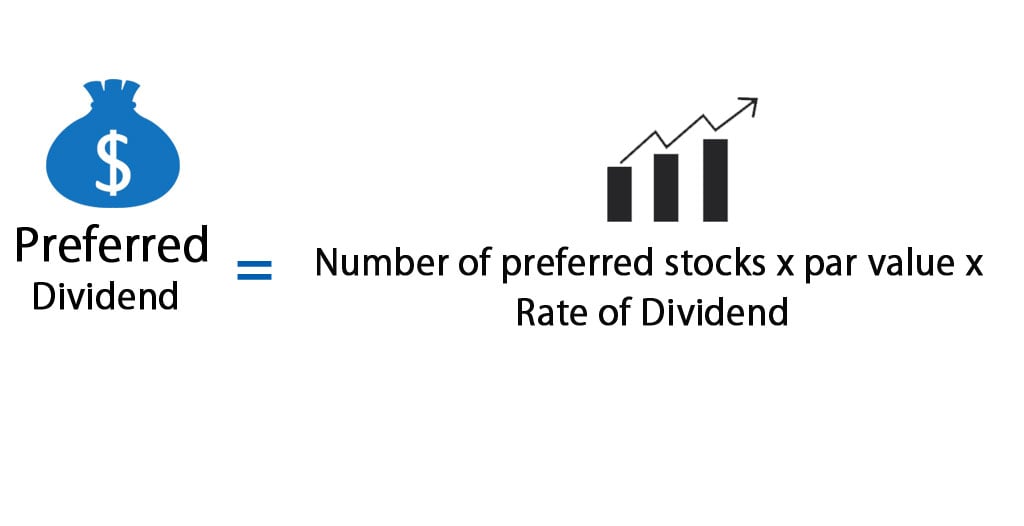

Preferred Dividend Formula Calculator Excel Template

Preferred Dividend Formula Calculator Excel Template

Dividend Payout Ratio Dpr Diukur Dengan Menggunakan Rumus

Dividend Payout Ratio Dpr Diukur Dengan Menggunakan Rumus

Pdf Pengaruh Likuiditas Profitabilitas Leverage Dan

Pdf Pengaruh Likuiditas Profitabilitas Leverage Dan

Dividend Per Share Overview Guide To Calculate Dividends

Dividend Per Share Overview Guide To Calculate Dividends

Dividend Payout Ratio Meaning Examples How To Interpret

Dividend Payout Ratio Meaning Examples How To Interpret

Analisis Pengaruh Nilai Tukar Inflasi Dividend Yield Dan

Analisis Pengaruh Nilai Tukar Inflasi Dividend Yield Dan

0 Response to "Rumus Dividend Payout Ratio"

Post a Comment