Loan To Deposit Ratio

Largest U S Banks Should Gain Considerably Over Coming

Largest U S Banks Should Gain Considerably Over Coming

Loan-deposit ratio

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages) (Learn how and when to remove this template message)

|

Loan-deposit ratio (LTD ratio or LDR) is a ratio between the banks total loans and total deposits. The ratio is generally expressed in percentage terms

If the ratio is lower than one, the bank relied on its own deposits to make loans to its customers, without any outside borrowing. If on the other hand the ratio is greater than one, the bank borrowed money which it reloaned at higher rates, rather than relying entirely on its own deposits. Banks may not be earning an optimal return if the ratio is too low. If the ratio is too high, the banks might not have enough liquidity to cover any unforeseen funding requirements or economic crises. Banking analysts commonly used metric for assessing a bank's liquidity.

The LDR is not the only metric used to ascertain a bank's liquidity. Modern banks today have multiple sources of finance beyond equities and deposits. The diversity of financing sources reduces the importance of LDR in determining a bank's health. Basel III which is part of the Basel Accords provides various complementary statistics to measure banking liquidity more comprehensively.

Gallery Loan To Deposit Ratio

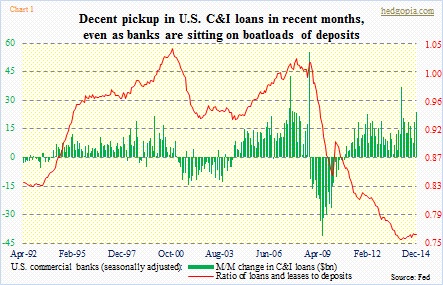

Separating Bank Loan Signal From Deposits Noise Wsj

Separating Bank Loan Signal From Deposits Noise Wsj

National Regional Banking Conditions Detailed In Latest

National Regional Banking Conditions Detailed In Latest

Loans To Deposits Ratio Of Top 1000 Banks Based On

Loans To Deposits Ratio Of Top 1000 Banks Based On

Indonesian Banks Face Liquidity Crunch As Loans Pick Up

U S Banks Loan To Deposit Ratio Inching Up But Yet To

U S Banks Loan To Deposit Ratio Inching Up But Yet To

The Forecast Variance Error Decomposition Of Loan To Deposit

The Forecast Variance Error Decomposition Of Loan To Deposit

Q2 2015 U S Banking Review Loan To Deposit Ratio

Brad Setser در توییتر As A Result The Lira Loan To Deposit

Brad Setser در توییتر As A Result The Lira Loan To Deposit

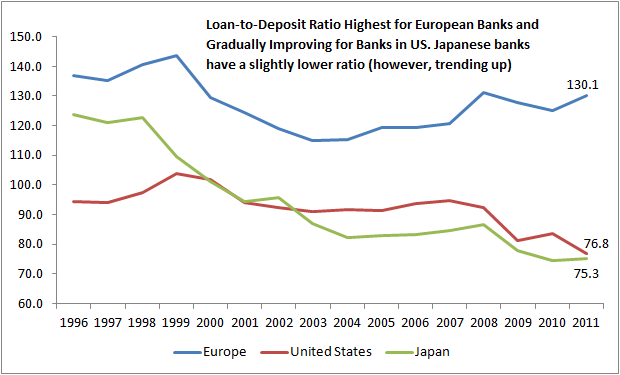

U S Banking Sector Looks Relatively Attractive Compared To

U S Banking Sector Looks Relatively Attractive Compared To

Loan To Deposit Ratios For Largest U S Banks Show Signs Of

Loan To Deposit Ratios For Largest U S Banks Slide In Q3

Loan To Deposit Ratios For Largest U S Banks Slide In Q3

Loan To Deposit Ratio Ltd Download Scientific Diagram

Loan To Deposit Ratio Ltd Download Scientific Diagram

Why Is The Loan To Deposit Ratio Declining For Us Banks

Why Is The Loan To Deposit Ratio Declining For Us Banks

Loan To Deposit Ratio Austrian Subsidiaries Download

Loan To Deposit Ratio Austrian Subsidiaries Download

The Loan To Deposit Ratio And The Trouble With Us Finance

The Loan To Deposit Ratio And The Trouble With Us Finance

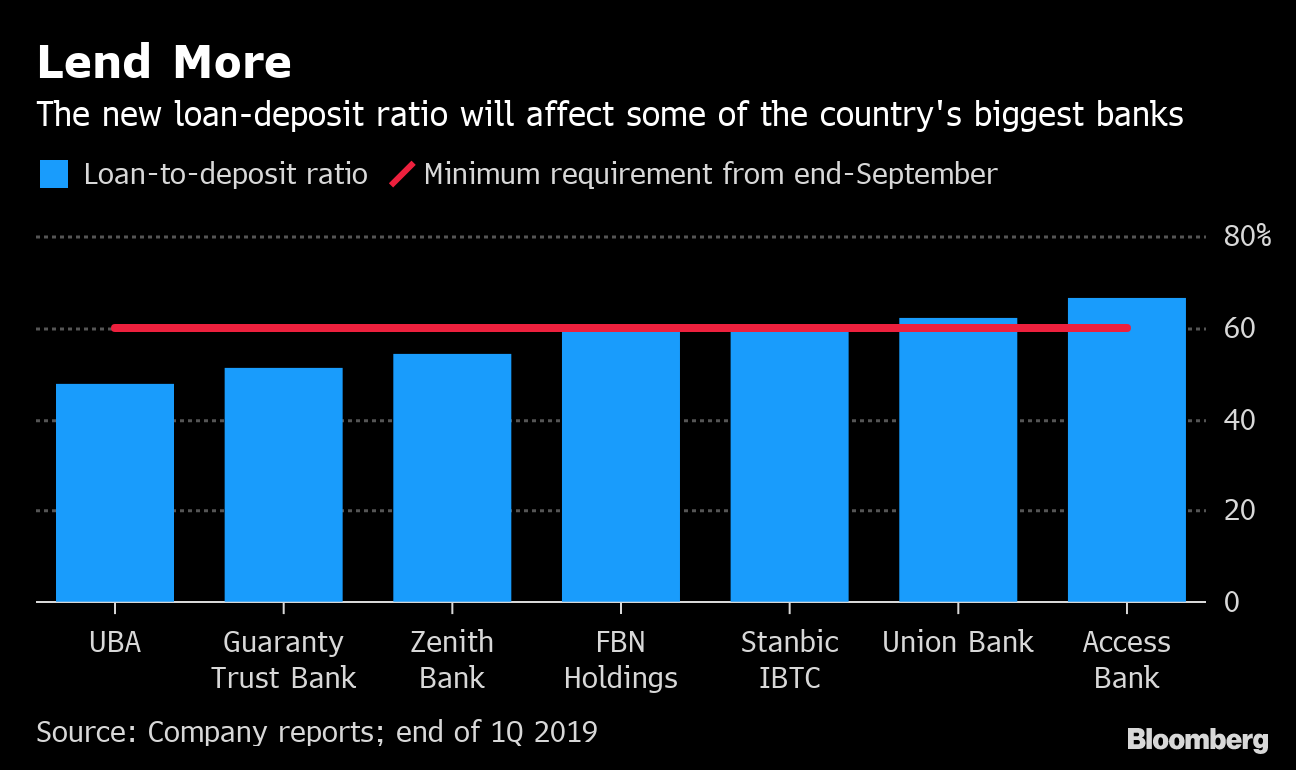

Growth Hungry Nigeria Tells Banks To Use Or Lose Their Money

Growth Hungry Nigeria Tells Banks To Use Or Lose Their Money

The Relationship Between Loan To Deposit Ratio And Bank

The Relationship Between Loan To Deposit Ratio And Bank

The Deposit To Loan And Lease Ratio Endless Metrics

This Is What European Banks Loan To Deposit Ratios Look

This Is What European Banks Loan To Deposit Ratios Look

Singapore S Surging Loan Deposit Ratio Asian Banking Finance

0 Response to "Loan To Deposit Ratio"

Post a Comment